This article is third & final part of our commentary on B2B opportunity in India.

In Part 1, we talked about how to identify B2B opportunities on key value vectors (more, macro view) and in Part 2, we covered how to go deep into evaluating an opportunity from, for example, unit economics lens (more, micro view)

This part is more about building long term moats, hence the pun, Supremacy!

Unless worked upon actively, B2B businesses see depletion of margins over long term

If you have read the previous article, you probably know that we at Sparrow Capital believe that B2B businesses might look appealing because of medium term information asymmetry — buyers looking for new suppliers, new geographies, newer products or services, newer capabilities etc, and vice versa.

Some examples:

- new geographies as export/import market

- new suppliers as de-risking current suppliers such as those in China+1 strategy

- new products as novel formulations or new type of fabric

- new capabilities as logistics or credit

It is this novel know-how or information asymmetry, that buyers or suppliers do not necessarily have or do not have the bandwidth to build. Consequently, they look towards a platform or intermediary over short or medium term and pay up a premium.

We think of this as the market not operating at equilibrium in a strict demand-supply curve. It`s a version of inefficient market which means profits for early adopters.

As markets do reach equilibrium, the information asymmetry or call it inefficiency, if you may, shall go away, and margins shall shrink

Or simply put, more competitors learn the ropes and enter the market, making these capabilities commodity and push prices downwards.

We have seen this happen in multiple industries, in which brokers or middlemen (which B2B platforms often set to modernize) face pricing pressure.

For example, in a largest industry such as FMCG or CPG, the role of distributors is reduced to being a provider of cheaper capital to large brands (HUL or P&G) in the value chain. Many large brands today own last mile sales and only use distributors as forward stock points and provider of credit to the end retailers.

This is also happening because the suppliers are big and have enough supply power to build capabilities in house or buy them, and consequently squeeze you out.

In another example, digital brokers or LogisticTech, who do not own assets, are ever struck in competitive wars on pricing. Because many competitors have entered the industry — the know-how has spread — who are willing to work on lower margins. We talk about this more in the later part of the article. Price has become the key value vector

We think a 3-point approach could be used to defend margins

Overall, as an intermediary, your margins shall be squeezed from both supply and demand side, as we have discussed above and as I have summarized in the exhibit below.

We think, this problem can be structurally addressed by:

(1) long term investments in your value vectors to continue to demand margins from demand side

(2) democratizing execution stack for your fragmented supply base to mitigate supplier power and mitigate margin pressure

(3) Thinking about vertical integration — either down-stream or up-stream.

Let us talk about this one by one.

(1) Long term investments in value-vectors

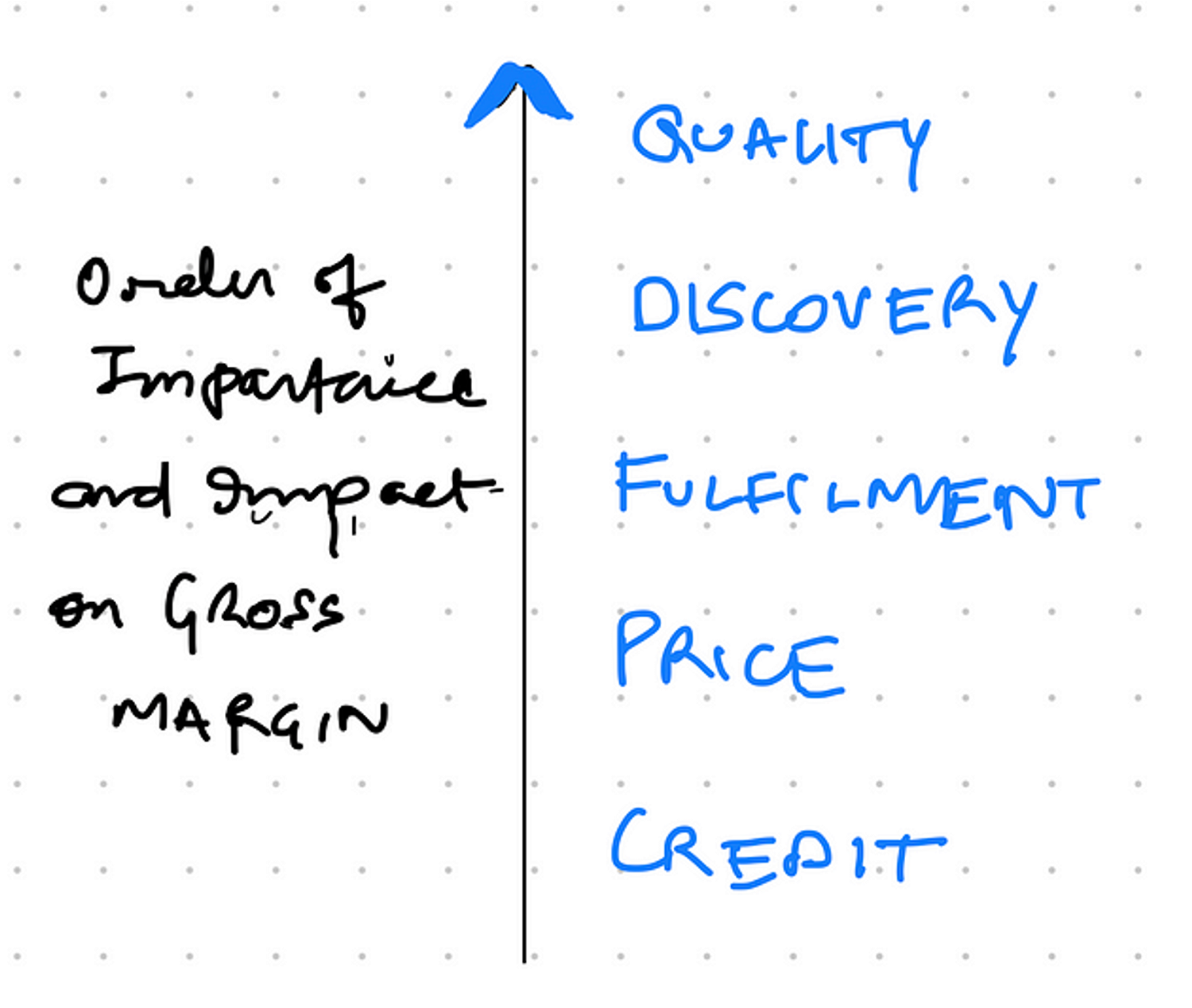

As we have stated earlier in Part 1 that identification of value vectors is really important, and that it determines the quality of a category and short to medium term moat. We will reiterate it again in the exhibit below

We will not get into which vector is more important vs other. Part 1 covers that in extensive detail. What we want to talk about here is long term investment in identified value vector!

At every juncture of your company`s journey, you will have one or a combination of value vectors at play. It is important to identify which ones are going to play out over long term, as in when market does approach equilibrium.

Lets say you are wining the market with Price in short-term but know that Credit is going to play a deeper moat over long term, it would be advisable to think about directing capital / investments in building Credit as a moat — getting needed licenses, investing in equity to lever up balance sheet, for example.

If Quality is going to be the long term vector, investing in building your brand and capabilities around quality — technology, people or processes — should be where most of your re-investment in the business should go.

Doing this will hopefully mean that you are supposedly adding value in the chain and you should get a higher slice of the profit pool than mere capital-as-an-input kind of margins (margins for deploying your capital as Working Capital).

(2) Democratization of execution stack

As we have iterated in the past, we are big fans of supply fragmentation, precisely because it could help in defending margins over long terms

When the supply side is fragmented, the supplier power is low. One, they do not have a fat balance sheet to build capabilities in house. Two, they usually do not have market forces to bring more competitors in the market and push pressure on pricing. Third, they shall continue to rely on you for the execution stack i.e. the key capabilities that they need to service demand. We will expand on this.

Fragmentation is an enemy of efficiencies of scale. And thus, your supply is dependent on you for many important parts of their execution workflows. Some examples.

- Workflow SaaS like Software to manage their internal operations such as a simple Order Management System or a project planning application

- AI capabilities such as inspection, quality assurance, that they might not be able to deeply build without the data.

- Relationships to avail trade finance which without your intervention will be costlier

- Supply chain efficiencies — being able to get better rates because of your aggregation advantages

Some of these could be long term value vectors as well, for example, your own entity to provide credit, if you do think Credit is a long term value vector.

Conversely, some of this could be the relationships / partnerships you bring on the table because of sheer scale if Credit is not a long term value vector, for example.

Or it could be a combination of both. The key is to build (fragmented) supply side hooks.

(3) Thinking about vertical integration

As the market approaches equilibrium, profit pools begin to reallocate. In a typical value chain, a good chuck of them are aggregated between manufacturers and retailers.

Manufacturing companies typically operate at 10–20% EBITDA margins while Retail operates at 5–15% EBITDA margins. It must be noted that B2B companies Gross Margins are often sub 10%, implying a much lower sub-5% EBITDA profiles.

In other words people who own the product or the consumer also own a big chunk of the profit pools.

Thus, over long term, B2B players must think about upstream or downstream integration. Downstream integration in our opinion is harder as the moving from a B2B business to a owning end consumers is an orbital shift in the strategy and the DNA of the company

Thinking about owning manufacturing could be better. This does not necessarily mean starting to build factories on your own at. This could mean things such as blocking supply capacity with your manufacturers in lieu of minimum guarantees, if you have demand flows.

It could also mean aligning lesser capital-incentive parts of the manufacturing process, for example, Quality Control or the Software stack, if any. The idea is to be as closer to producers as possible.

We wont get into the down-streaming or the end consumer aspects of this. Think there is enough and more written about eCommerce, Headless commerce, and D2C brands. A great example of this is Shein story. We highly recommend reading this post from Not Boring blog on this.

Closing Thoughts

B2B is an interesting category that is lucrative from a short term traction standpoint but at the same time extremely hard to navigate over long term.

We think this is at best an incremental innovation category with little whistles and hook to be disruptive. Or, a lot about business model engineering than tech or product related moats.

That being said, both founders and investors must be intellectually honest about this fact, and think in terms of

(1) Real Revenue and not GMV,

(2) Revenue quality in terms of supply fragmentation and value vectors,

(3) ROE and ROCE implications, and

(4) moats to defend dilution of information asymmetry over long term

We are close watchers of the space and would love to chat if you have notes to exchange and or are thinking of building in the space. Do reach out.

.png%3Ftable%3Dblock%26id%3D0fc05530-04e6-4e8d-bec2-ef66f2be1f03%26cache%3Dv2?width=1500&optimizer=image)

.png%3Ftable%3Dblock%26id%3Db5f686e4-3836-4e04-8011-217ebb97aa8a%26cache%3Dv2?width=1500&optimizer=image)