In Part 1 of this series, I talked about how at Sparrow Capital, we define the B2B opportunity. In this part, I will talk about how to think about category selection more deeply — more quantitative than qualitative — essentially building on from what we covered already.

But before we go there, here is a quick recap on quality assessment

We like two key tenets when it comes to liking B2B business

Tenet 1: Supply side fragmentation; which allows for near term moat, consequently preventing you from potential dominance of suppliers down the road. Here is quick rundown on Power of Suppliers in the Porter 5 forces model

Tenet 2: Which primary value vector(s) — (1) Discovery (2) Quality (3) Fulfillment (4) Price and (5) Credit — is going to be dominant. We think dominating presence of #1 over #5 is better for moat building. More the merrier, so on and so forth.

Now that, this is out of the way, we also like to understand the depth in a category from a quantitative standpoint.

Yes, the India opportunity is big

Our reasonable top-down estimates put B2B commerce in India to be this category at 25–30% of a quarter of India GDP i.e. a $750B+ opportunity. This includes the entire manufacturing sector which contributes 19% of India GDP and a section of agriculture sector outside of what the Govt. buys, and forestry.

With tailwinds in favor of growth of manufacturing, this number is poised to grow even more. A big chunk of this pie is also destined to go into global markets as part of exports.

We tried to dissect the size of individual categories from a top-down approach but failed miserably as reliable & well sourced ground-up data is not available. But it should not matter as what we are going to make a case for picking categories from a bottom-up approach.

Pick or size categories not just on GMV but also on $100M Real Revenue potential

We believe that GMV alone does not cut it while looking at B2B business. Generally speaking, high AOV (avg. order value) and low order frequency, does not make a great case for evaluating something by GMV.

We like the Gross Margin / Revenue approach as well. Gross Margin when you are booking GMV on your book i.e. inventory lies on your balance sheet. Revenue when you get commission by movement of inventory from supplier to buyer, for example, in the case of drop shipping. We call this Real Revenue.

I have written about GMV and revenue here in the past, if you want to dig more.

Categories where real revenue of $100M is possible at 5–10% market share, should be a good point to start.

For example, there maybe a $10B GMV category which has 2% margin / commission structure, i.e it has $200M real revenue pool. Thus at 5-10% market share, your real revenue potential is at $10-$20M, which is low.

Whereas a $3B category with 30% margin / commission structure has a $900M real revenue pool and to have $100M revenue, you need 11% market share, which is not that bad.

Why 5-10%? we think these are not winner takes all markets and thus low single-digit market share seems reasonable, from a heuristics point of view.

That being said, the potential or the size of category should really be looked at from real revenue potential lens i.e. the margin structure in the category.

Chose categories that have working capital cycle of less than 45 days, at steady state.

Unless you are building own manufacturing capacity (yes, some startups are actually going that route), almost a big part of your employed capital (equity) will be go towards managing working capital cycles.

Just a recap, Working Capital = Inventory + Receivables — Payable

We have looked at many legacy public companies that have working capital cycles as high as 90 days, signifying trading like characteristic. Essentially, the buyer or the supplier or both are funding their working capital cycles off your capital, and passing a sliver of margin pool to these (trading) companies. This is also where Credit, and Price vectors are more pronounced.

On the contrary, we believe that if B2B players are adding significant value in the value-chain — perhaps, Quality and Discovery — it must reflect in shorter receivable or payable days.

Inventory is just critical hygiene management and in many ways your operation muscle or moat!

High working capital say 60–120 days essentially means that the business will be at 3–6 turns. In addition, we see EBITDA margins to be often in 2-5% territory, in these companies. This means that for a business to grow beyond 9–18% (turns*EBITDA margin) every year, it must employ more capital — equity.

Capital is raw material when working capital is high and is equity dilutive

45 days however mean 8 turns and 3% EBITDA margin means ~25% YoY growth at scale; top-line doubles every ~3 years without any equity dilution!.

Marry that with categories that have high Discovery or Quality, consequently higher EBITDA margins say 5%, implying 40% YoY growth; top-line doubles every ~2 years without any equity dilution!

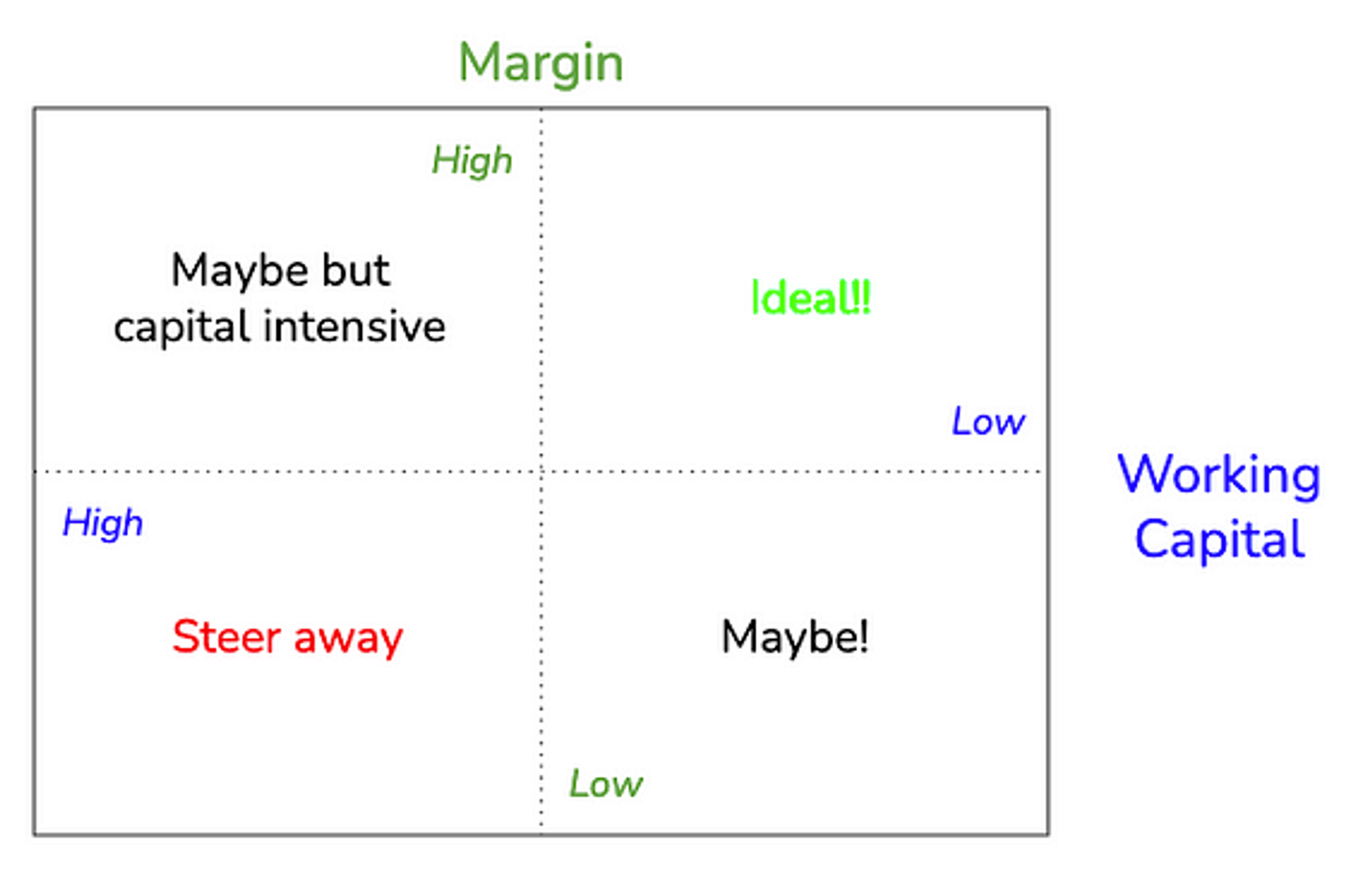

High working capital and high margin business still require upfront capital

We are not going to leave talking about working capital just yet!

The next logical question after what we discussed above is, what if the margins are high to justify high working capital? Say, 4 turns (90 Day NWC) and 10% EBITDA still means 40% non-dilute growth, right?

And similarly, if low margin profile is supplemented by low working capital.

Definitely, one can chose between the two but there are pros and cons of both.

In the former, you will need a lot of upfront investment of capital to get the profit cycle going. Remember, it will take you time to get to your ideal profitability state and until then you will have to front working capital. You must build strong financial acumen in terms of people, process and technology. Best of the best don't get the working capital right. Beware!

In case of the latter, i.e. low margin and low working capital, capital investment will be low but then there will be a question of what is the moat and will see high pressure from competitors. You must think to develop very strong distribution / GTM muscle to accumulate GMV, and dig deep to find long term moat.

Building leverage is recommended from Day-1

One way to mitigate working capital exposure is to build leverage. It can happen in two ways. Either by levering your own balance sheet or factoring — some sort of an invoice discounting program. A combination of both may also be possible.

Venture debt providers are a viable option to start thinking about leverage. They do look for comfort of equity investors and some history of topline growth. Most B2B companies start here. Typically Series A is when this option begins to unfold.

It must be noted, however, that this is not long term debt while the nature of a B2B business, courtesy of working capital needs requires additional capital for growth. For example, if you have grown 5x in an year, your working capital needs have also growth broadly 5x, assuming same terms. Not only you will have to find new debt but also find capital to refinance your existing venture debt. Daunting isn`t it?

Finding long term debt is key and will happen if you have profitability in sight right from Day 1, otherwise banks are not interested.

We also recommend building a very robust finance team from Day 1. Hiring a very strong finance controller early on or even thinking about a strong CFO as a potential co founder.

To run a credit program, you will have to be mindful of the quality of your buyers and suppliers. Large established buyer-base that is creditworthy is a good place to start. If you are working with fragmented suppliers or buyers, you will have to understand how difficult it is going to be to underwrite them.

One clear advantage credit programs brings is that you can avoid any exposure on your Balance Sheet and save you perpetual financing and refinancing cycles. But at the same time they are harder to do. We recently invested in Mannjal that enables B2B companies start and run their credit programs.

There is a third way too — build your own NBFC, which again a lot of companies are trying to do. In our opinion this is another business where capital is raw material. Not only its harder than your original B2B business but, notoriously complex to build from a DNA standpoint.

But everything is doable if done right. I have written about credit and startups in the past here. In case you want to give it a read

It all must add up to ROE profile greater than 20%

At the end of day, Venture Capital money will form a big part of capital structure of this company and thus it must adhere to high Return on Equity (ROE) hurdles.

We think categories that cannot structurally generate a minimum ROE of 20%, at maturity, are not good fit. VC asset class carries high hurdles rates (min. returns our investors expect of us) to justify our high risk profiles. Naturally, there are going to be some businesses that do not clear that bar.

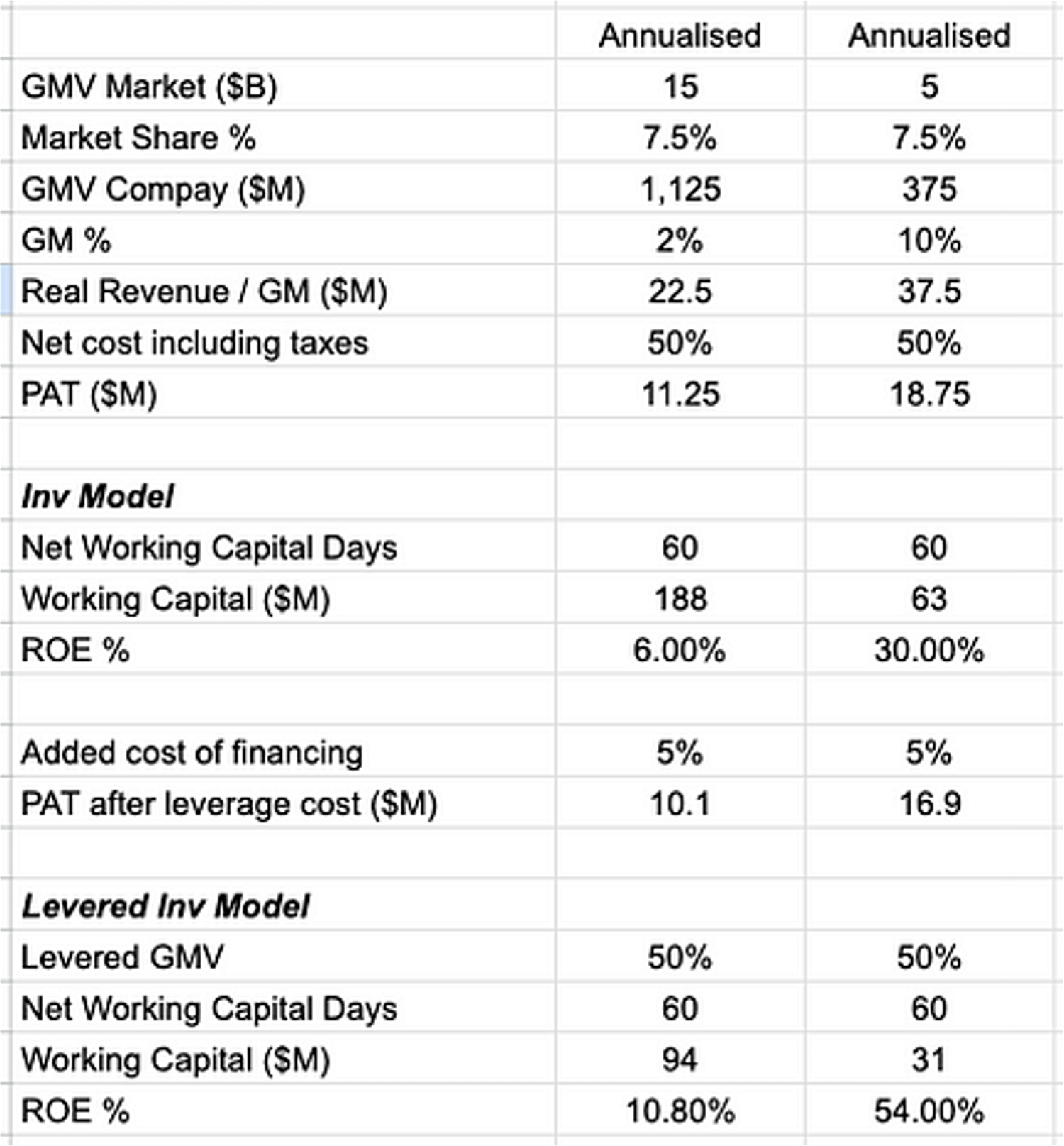

To understand how this works, lets bring back the two different categories with different Real Revenue potential as mentioned above. You can see in the table below that while both business make similar Profit After Tax ($10–20M), their ROEs look substantially different.

You can also see how leverage begins to improve ROEs — I assumed to finance 50% of GMV, the business will incur additional 5% of revenue as a cost. Note that these numbers are hypothetical and are only used to make a point that leverage is indeed very important and helps improve ROE profile.

We highly recommend Evaluating ROE profiles of B2B categories

Summing up

We must also state that these numbers are at steady state only to evaluate a category / business structurally. It is highly unlikely that you are going to be in situations, for example, where your working capital is at the ideal 45 Day number in your year 1 of operations.

Take these numbers from a directional evaluation only and we hope it will help you find some answers. We think that this quantitative lens is becoming even more important as we have stepped into an era of high interest rates.

At Sparrow Capital we continue to do a lot of work in the B2B space and have investments in Groyyo, Depo24, and now Mannjal. We further strive to be independent thinkers and love to partner with entrepreneurs who are as well.

In many of our investments, we worked with founders very closely, helping them sharpen their thesis, connecting them with people we know for product and idea discovery, just like a co-founder.

If you want to reach out and talk to us about this more, do give us a shout. we are available at yash@sparrowvc.com and aakash@sparrowvc.com.

Fundamentals are coming back in a big way

.png%3Ftable%3Dblock%26id%3D0fc05530-04e6-4e8d-bec2-ef66f2be1f03%26cache%3Dv2?width=1500&optimizer=image)

.png%3Ftable%3Dblock%26id%3Db5f686e4-3836-4e04-8011-217ebb97aa8a%26cache%3Dv2?width=1500&optimizer=image)